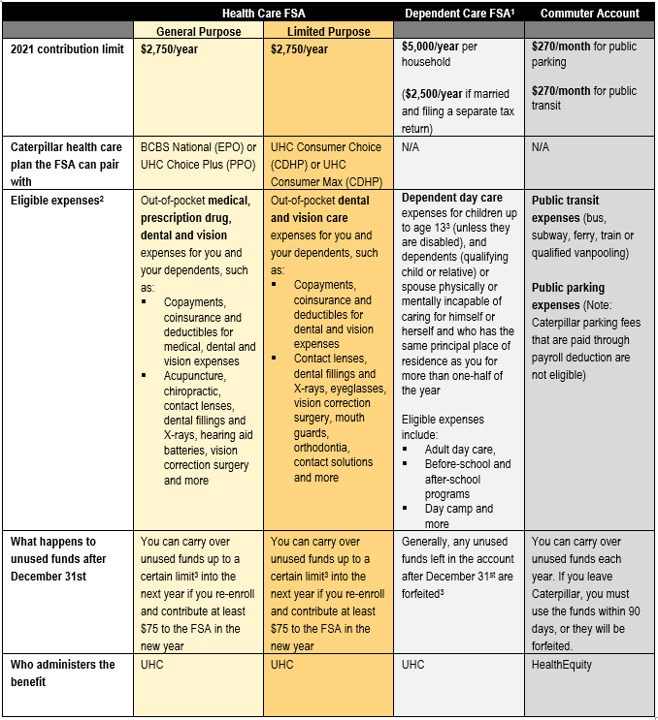

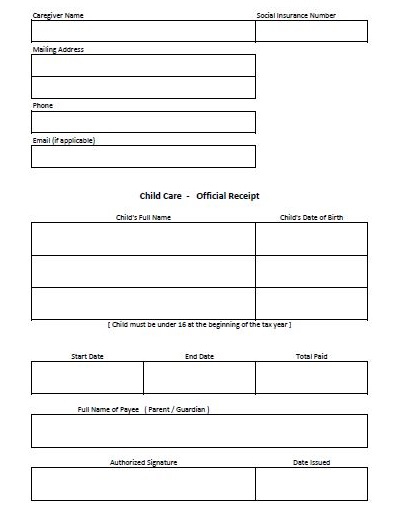

dependent care fsa rules 2021

2021 to 2022. Dependent Care Flexible Spending Account Basics.

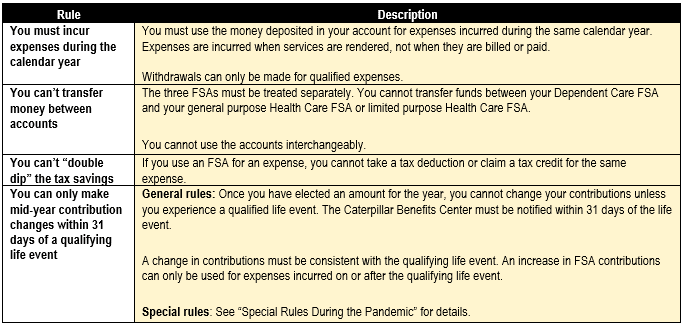

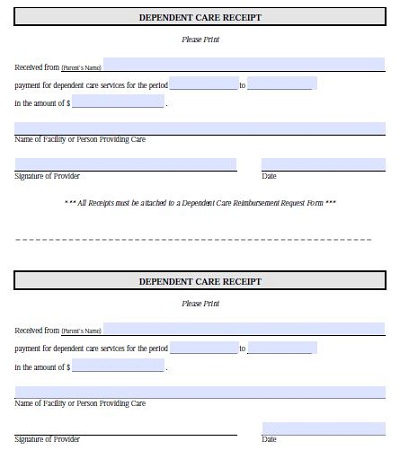

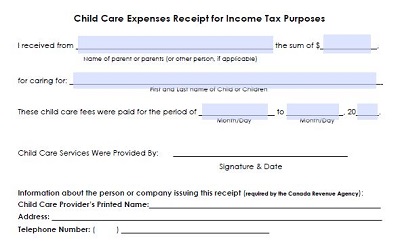

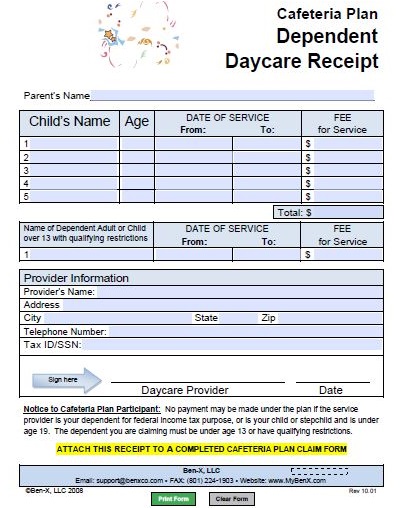

30 Sample Receipt For Child Care Services Pdf Word Template Republic

The Savings Power of This FSA.

. This relief applies to all health FSAs including HSA-compatible health FSAs and also applies to all. Elevate your health benefits. A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or.

Temporary special rules for dependent care flexible spending arrangements FSAs. Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. The IRS has special rules for who gets to.

Remaining in an employees health FSA as of December 31 2021 to the 2022 plan year. As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. ARPA increased the dependent care FSA limit for calendar year 2021 to 10500.

Ad Custom benefits solutions for your business needs. A dependent care flexible spending account can help you save money on caregiving expenses but not everyone is eligible. In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing.

The 2021 dependent-care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and. Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March. Section 214 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 provides temporary COVID-19.

Health and dependent care FSA plans can now carryover ALL remaining balances from 2020 to 2021 and then again from 2021 to 2022. Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. As with the standard rules the limit is reduced to half of that amount 5250 for married.

Employees may carry over all or some of their unused health andor dependent care FSA funds from a plan year ending in 2020 or 2021 explained Marcia Wagner founder of. Earlier in 2020 the IRS updated the rules to increase. 15 clarifies that employers may extend the dependent care FSA claims period for a dependent who ages out by turning 13 years old.

Easy implementation and comprehensive employee education available 247. All unused Dependent Care FSA funds in your account will be carried over from the current plan year into the subsequent plan year not limited to the two and a half. Once you choose an annual contribution your employer will deduct that amount pre-tax in equal parts from each paycheck.

Dependent Care FSA FAQs Alicia Main 2021-08-23T130406-0400. Dependent eligibility situations where a dependent satisfies or. IR-2021-105 May 10 2021 The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that.

DCFSA funds are made available only as. Get a free demo. IRS Notice 2021-15 issued Feb.

Limited Purpose Fsa Lpfsa Optum Financial

Pay For Childcare Here S How You Could Save More Money This Year

What Is An Fsa And How Does It Work Wsj

How Does A Dependent Care Fsa Work Goodrx

How Does A Dependent Care Fsa Work Goodrx

30 Sample Receipt For Child Care Services Pdf Word Template Republic

How Our Non Discrimination Testing Solution Supports Partners Wex Inc

Covid 19 Pandemic Dependent Care Reimbursement Program Chevron Human Resources

30 Sample Receipt For Child Care Services Pdf Word Template Republic

Dependent Care Flexible Spending Account Jhu Human Resources

150 Expense Categories To Help You Track Your Personal Finances Budgeting Finances Budgeting Money Management Advice

30 Sample Receipt For Child Care Services Pdf Word Template Republic

Flexible Spending Accounts Mychoice Accounts Businessolver

Can A Husband And Wife Both Claim Flexible Dependent Care Benefits